|

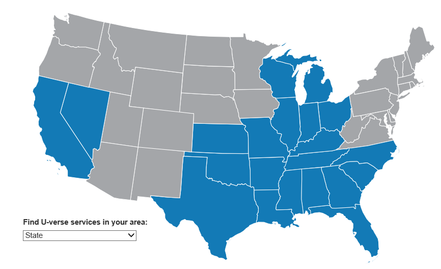

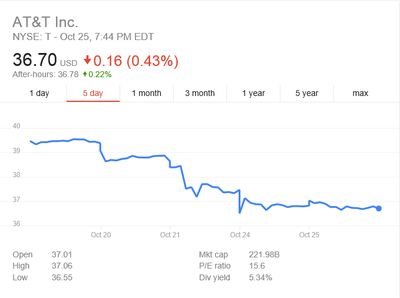

Mergers and acquisitions, it’s a part of free enterprise and a capitalist economy, and they come small and big. AT&T and Time Warner both are familiar to mergers and acquisitions, but neither know small. Some can be good for the economy and some can threaten it. In 2014 AT&T dropped $49B for DirecTV and made the sale. In 2009 Time Warner let go of Time Warner Cable, which then got bought by Charter Communications (now named Spectrum) for $60B in May. AT&T seems to have been beefing itself up since 2014, the once simple telephone, wireless, and Internet company is en route to be a media giant like Comcast. Compared to those mentioned above, the price tag for this merger trumps those. AT&T is ready to pay $85B for Time Warner. If this merger passes the regulatory hurdles (FCC & FTC), AT&T will pass up Disney and be right along side Comcast in the media and telecommunications industries. AT&T owns DirecTV, the 2nd largest TV provider in the US, but AT&T also has their own TV service called UVerse. AT&T UVerse has been around since 2006, but a decade later it is much more widespread and has a 4 part package to it. Those 4 parts are: TV, Internet, Landline Telephone, and Wireless (cell phone). UVerse however is only available in select states as shown below. Image source: http://www.att.com/local/ However since 2014, UVerse availability doesn’t matter as much to AT&T because AT&T has DirecTV which is available almost nationwide. AT&T even promotes on their website, if you’re not in the UVerse area, go to DirecTV. So what does this mean exactly? Since AT&T controls the pipes to bring consumers content (DirecTV and UVerse), them buying Time Warner makes perfect sense, to control some content, and Time Warner has a lot of it. Time Warner owns: TBS, TNT, CNN, HBO, Cartoon Network, and Warner Brothers. This gives AT&T’s UVerse and DirecTV almost exclusive content of some of the biggest names in TV. This is great for AT&T, they’ll no longer have to pay Time Warner to use their content, but will they have control over pricing for their competitors? That is one big question regulators need to look into and find an answer, because that could upset the industry big time. If AT&T wants consumers to believe this is good for them, they need to start promoting and advertising on what AT&T and DirecTV will offer if the deal passes. Lower UVerse and DirecTV prices would be a great way to start. If AT&T can make that argument to the regulators in Washington, then this deal should have no trouble passing. If AT&T can’t make a decent enough argument to regulators and convince consumers that this deal will make competition better and benefit the consumers, then this deal is done for. You may be asking yourself, what about Comcast and NBCUniversal? Isn’t that the same thing? Yes it pretty much is the same deal, a large content distributor bought a content provider, but did it really benefit consumers? Most Comcast customers would say no. Like Comcast and NBCUniversal, AT&T-Time Warner is just more consolidation it seems, but consolidation is always good for the market, if it benefits consumers. The AT&T-Time Warner deal has so much potential for benefitting consumers, but talk is one thing and action is another. Like stated above, AT&T needs to make the case, persuade, and then execute it for this to be a win-win. If the deal does go through, it’s either going to force Verizon and other like-minded companies within the industry to go out a buy a content provider or create antitrust lawsuits. Discovery Communications CEO David Zaslav, echoed that in a Fox Business article. Zaslav said “The bigger consolidation question is what happens now to the distributors? Do the cable operators now have to find a wireless solution in the U.S.? Most of them inside the U.S. have felt that they needed to. Does Verizon now look at AT&T and say wait a minute? They have DirecTV and now they have a huge amount of content, we don’t have any one of those things. Do we need one or the other?”. Antitrust lawsuits could arise due to the fact that AT&T will have a lot of power, and like Donald Trump said “too much concentration of power”, which is true. However it depends what AT&T does with that power; if they abuse it, expect lawsuits, and if they don’t, expect competition to spark. Touching on Trump’s thoughts of this, like he said in Gettysburg, PA, he thinks this gives AT&T too much power and deletes a competitor in the market while strengthening another one, which is true. Trump wants to break up the deal, but he should wait and see how it plays out. I get Trump’s concern, but being a capitalist country we need to let the free market work it out. This could very well benefit consumers, but at the same time it can harm competition and the market, or worse case it hurts consumers and competition. AT&T’s goal is to make as much money as possible, and this deal will reach and exceed that goal massively. AT&T will have to take on some debt at first though, about $175B according to The New York Times. In order to make this purchase, AT&T will have to pay with “new debt”, it’s own stocks, and “on hand” cash, which AT&T can easily and affordably do. AT&T also has a bridge loan committed to this deal for about $40B, JPMorgan Chase representing $25B and Bank of America representing $15B, and that’s a lot of cash to hand out. However this cash will only be used as a last resort. All this information is from The New York Times. Shareholders of both AT&T and Time Warner seemed to have not publicly addressed this merger, but I’m sure there is a mixture of for and againsts within in both companies, even for stakeholders. Also if this deal does not go through, since this merger has been accepted between both companies, employees from both companies working directly with the merger have their jobs on the line. This is because during a merger, employees working for both companies included in the merger know each others ways and secrets, so if this merger gets struck down in Washington the employees have to be let go. All AT&T consumers can expect everything Time Warner to be exclusive to them, or they’ll see a lot more of Time Warner’s content on their devices. Like stated earlier, AT&T must lower their prices for UVerse and DirecTV since they’ll own a large chunk of content and no longer have to pay for it. AT&T can make customers and regulators very mad if this deal doesn’t trickle down and only raise consumer prices and issues. Expect AT&T’s wireless division to take full advantage of having Time Warner’s resources too, think advertising and apps. That is something consumers could look forward to, well apps that is, AT&T will look forward to that ad revenue. AT&T users could soon have exclusive TBS, HBO, CNN, and other Warner networks/studios content and apps on their smartphones, and that could attract new customers as well. REAL DEAL: Pay-TV AKA streaming TV, like Sling TV and Playstation Vue, will for sure come out of this. That is the future, and AT&T knows that, and quite frankly, I believe the both the telecommunication and media industries know that. AT&T will be able to stream exclusively Time Warner content, and therefore use that savings in cash on other content. AT&T will give DirecTV a direct product to compete against DISH Network’s Sling TV. That alone will shake up the industries and the markets, and it’ll be the better, a win-win for all stakeholders. This product alone would be a real money maker for AT&T, because it’ll more than likely be sold under the DirecTV brand, and more people have DirecTV than DISH Network. DirecTV is up there with Comcast, and is a very common household name. AT&T’s UVerse simply doesn’t have the consumer reach that DirecTV does, nor the resources...yet. It’s clear AT&T is taking advantage of the “multiple screens” approach. AT&T wants their customers, and their hopeful future customers to be reached on every screen possible. AT&T is simply maximizing their profit and taking the Comcast approach. Anyhow here’s the stocks for each: AT&T shareholders seem scared, probably due to regulatory risk and price tag. Time Warner shareholders seem happy and optimistic about a TWX investment. Could be a home run for both stocks. Sources:

http://www.latimes.com/business/la-fi-trump-att-time-warner-20161022-snap-story.html http://www.foxbusiness.com/markets/2016/10/24/time-warners-embarrassment-riches-key-to-at-ts-85b-deal.html http://www.foxbusiness.com/features/2016/10/24/why-at-t-time-warner-deal-is-good-for-consumers.html http://www.foxbusiness.com/features/2016/10/24/discovery-ceo-at-t-time-warner-poses-big-question-for-distributors.html http://www.foxbusiness.com/markets/2016/10/25/merge-ahead-time-warner-at-t-deal-sparks-hunt-for-direct-to-consumer-access.html http://time.com/4542446/att-time-warner-history/ http://www.nytimes.com/2016/10/24/business/dealbook/att-plans-to-shoulder-mega-debt-merger-time-warner.html?_r=0 http://www.kansascity.com/news/business/article110197917.html Image Sources: https://www.imore.com/sites/imore.com/files/styles/large/public/topic_images/2014/topic_att_logo.png?itok=2Wc_1f7M http://i.forbesimg.com/media/lists/companies/time-warner_416x416.jpg

1 Comment

|

Categories

All

Archives

October 2020

|