|

T-Mobile has been making the headlines on a weekly basis it seems, and this week they brought Sprint along with them. Though it was really Sprint's majority owner SoftBank who brought the news, and this really reflects how the tables have turned in the wireless carrier world.

Multiple sources citing Reuters reporting that SoftBank may cede control of Sprint to Deutsche Telekom who owns T-Mobile. SoftBank has not yet discussed anything with Deustche Telekom due to a FCC rule prohibiting discussions between competitors during spectrum auctions, which one is currently going on. This is all per Fox Business Once the auction ends expect talks to ramp up. This potential merger could create a "super-carrier", but due to that possibility alone, regulators are bound to fight this merger hard. The potential merger may be a copy of the failed merger of Sprint and T-Mobile back in 2014. In 2014 Sprint, well SoftBank, had a $32 billion deal on the table with T-Mobile and all they need was government approval, and they couldn't get it. The FCC wasn't into that much of consolidation, and so Sprint walked away from the deal, and Sprint fired CEO Dan Hesse who was succeeded by current Sprint CEO Marcelo Claure. This all according to Forbes. Here is a video from Bloomberg on the potential deal:

This deal would be huge no doubt, and it's funny how the tables have turned. In 2014 it was Sprint wanting to buy T-Mobile, now it's SoftBank wanting to cede control of Sprint to Deutsche Telekom who owns T-Mobile. It's only logical that T-Mobile and Sprint merge, and since Sprint is being ceded to T-Mobile's owner, Sprint is on the losing end. Now Sprint wouldn't fully go away, but employees will and branding.

The deal does have potential for good though, this would create a direct competitor to Verizon and AT&T and may even stir more innovation and competition within the industry, because it really would be more of a level playing field. T-Mobile is knocking on both Verizon's and AT&T's doors after blowing through Sprint's, and if this deal goes through it will be a Cinderella story for the ages. Why? Because T-Mobile use to be the smallest of the 4 major US carriers, now it has the chance to become 2nd or even 1st. However, this merger may have the chance to do some bad, and the FCC will pick that up. The potential merger would be a big one and create a worse oligopoly within the industry. How so? With T-Mobile eliminating Sprint for good there may not be incentive to go after AT&T and Verizon because T-Mobile will be just as big, so maybe the price war will die and companies will focus on themselves and not rivals. T-Mobile is really responsible, AT&T too, for the current price war and competition going on within the industry. According to Fox Business, Deutsche Telekom could receive offers from Comcast and DISH for T-Mobile. DISH Network is the more likely one, honestly it would be the best choice for T-Mobile, Sprint, and even Verizon. AT&T already scooped up DirecTV, DISH Network has Sling TV (Internet Pay TV), Verizon is getting into Internet TV, and it's clear the future of TV is shifting towards subscription based Internet TV. DISH Network would be a great asset and/or partner with the remaining three carriers, and T-Mobile sounds like they'd be the ones to do it. Comcast however could easily scoop up T-Mobile and become a new and direct competitor to Verizon, AT&T, and Sprint. Sprint would really have to merge with someone then. Overall, big things are happening within the telecom industry, and big things are going to continue to happen in the telecom industry. In the US, the FCC has a business friendly, pro-deregulation face as the chariman Mr. Ajit Pai, and the US has a business friendly, pro-deregulation president Mr. Donald J. Trump. Innovation and competition shall flourish in the US during the next four years. Stakeholders should be excited, but have a right to be nervous, especially Sprint employees, but consumers should be excited to think what may come out of such a deal. Shareholders see a great opportunity for T-Mobile. On a funny note though, T-Mobile's and Sprint's CEOs aren't the best of friends and on occasion take jabs at eachother on Twitter and the shows, here's a video of T-Mobile's CEO John Legere, on CNBC, saying he'd throw potatoes at Sprint's CEO, per NTK Network:

Feel the love? Not really, but is comical and all in business fun. The clip does mention at SoftBank still wanting to do a deal for T-Mobile, and this was back in August of 2016, but since then T-Mobile has really taken off, which probably prompted SoftBank to be willing to cede control of Sprint to Deutsche Telekom.

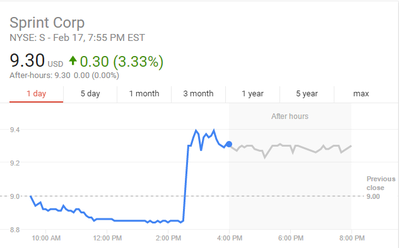

Again, the deal has it's perks, but has it's worries and the worries may be enough for the government to give it the 2014 reaction, which was no deal. With Ajit Pai and the Trump Administration in town, the deal may have a positive government reaction this time around. Here are the 1-day's for T-Mobile and Sprint per Google (click for larger image):

0 Comments

Leave a Reply. |

Categories

All

Archives

October 2020

|